An Exploration of Gnosis Safe Holdings

That was a question discussed on the Bankless podcast last month. Our resident data expert, Paul has been doing some exploration to come up with our own conclusion, and we believe we’ve got the answer with the data to prove it!

You can view our dashboard on Dune analytics here: https://dune.com/exponent/gnosis-safe-holdings-analysis

General Overview

We’re sampling from a population of Safe Proxies created from the Factory Contract v1.3.0. There are currently 58,353 total proxies created since ~ June 11, 2021 (199 created within the past 24 hrs). To focus our analysis, we’ll limit the present analysis to those that currently hold at least one of five major assets (i.e., WETH, WBTC, DAI, USDC, USDT) which is roughly 10.38% of all proxies created, or 6,055 proxies.

This 10.38% sample of all Safe Proxies currently holds roughly $3.3 Billion (USD) in value or 2% of Ethereum’s 158B market cap today. New Safe proxies are created everyday with 199 created in the past 24 hrs, 11 containing at least one major asset.

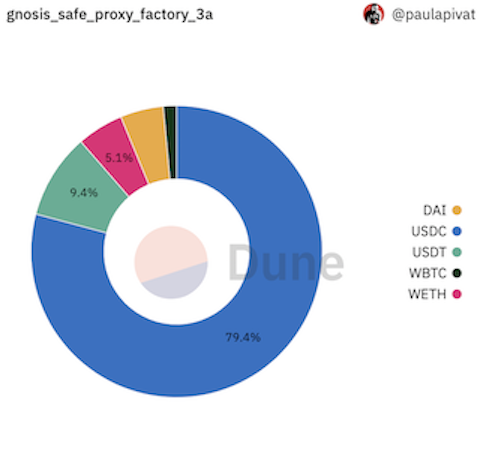

Breaking things down further, the $3.3 Billion (USD) value held in our sample of Safe Proxies is comprised of $2.6B worth of USDC (79%), followed by $310M worth of USDT (9%), then $168M worth of WETH (5%), $156M worth of DAI and $46M worth of WBTC.

Here’s a further breakdown of value:

511 Proxies hold at least 1M ($USD)

56 Proxies hold at least 10M ($USD)

2 Proxies hold at least 100M ($USD)

Interesting to note that USDC makes up 79% of the value held in these Safe Proxies.

Further partitioning our sample to those Proxies that hold stablecoins (i.e., USDC, USDT & DAI), we find that most hold less than <$1M (4949) and a smaller portion (486) hold more than >$1M. However, these latter vaults hold 88% of all USD value in stablecoins, amounting to $2.7B.

Most Safe users are relying on centralized stablecoins directly (~ 90% USDC, USDT) or indirectly ($140M in DAI). Given recent OFAC sactions from U.S. Treasury and action from the CFTC, risk-factors associated with centralized stablecoins is top of mind and makes these Safe Proxies a candidate for risk management through Dollar Diversification, Pool and Safe Dollar Yield strategies.

While a smaller portion of Safe Proxies hold only base assets (WETH or WBTC), 3,769 (or 62%) hold native ETH.

Of these 3,769 proxies, the most value is held by the segment that holds between 1000 - 5000 ETH or roughly $71M USD worth.

Conclusion

Overall, Safe has been Lindy for a couple years, but with $3.3 Billion (USD) locked since last summer (June 2021), this has never been more clear. As Safe vaults proliferate, there is a growing opportunity to advance Treasury and Risk management practices to secure protocols, DAOs and user funds. Exponent’s goal is to unlock capital deployment at scale, so that Safe treasurers can operate, preserve, and grow their treasury in a risk-conscious manner.